Faster cash

Reduction in contract-to-cash time for accounts receivable

Spreadsheets replaced

Inconsistencies eliminated with centralized system

Hours saved

Manual processes automated and bottlenecks reduced

Website: foxrobotics.com

Location: Austin, Texas

Industry: industrial automation

Fox Robotics builds intelligent forklifts that autonomously unload pallets from trailer to receiving dock in a warehouse. The company is solving one of the most challenging tasks that forklift operators face: unloading trailers without modifying the warehouse or requiring fixed locations. Fox’s first customer was DHL Supply Chain—one of the world’s most demanding supply-chain environments.

Fox turned to Hardfin as the company was accelerating growth and needed to automate hardware financial operations. They knew their manual processes wouldn’t scale. The finance team needed to streamline four related areas of the business:

Hardware-as-a-service (HaaS) companies often struggle with these four critical areas—they are disparate pieces of a hardware subscription that do not connect to each other. Hardfin helped connect these areas for Fox, creating enormous value for the business.

“A spreadsheet might work early on; but even when you’re making your first few sales, spreadsheets won’t tell you when to send invoices the way that a system will. They won’t track assets that have been deployed, or register that a billing item needs to tie back to the asset, which should be on your revenue schedule. Even with a few dozen assets in the field, it’s complicated to keep up. Just imagine more! Hardfin takes that pain away.”

Kevin Reich

Director of Finance

Standardizing contract definitions

Hardfin helps Fox determine asset triggers and define contracts

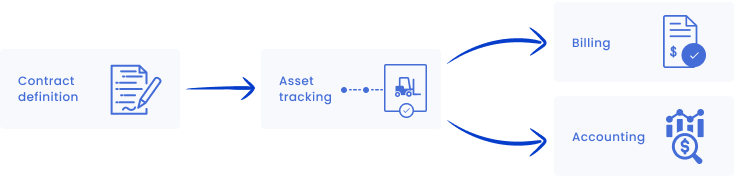

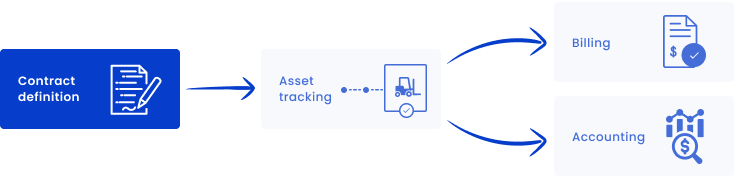

In Fox’s hardware-as-a-service (HaaS) asset lifecycle, software billing begins when a forklift is deployed at a customer site. When forklifts are rotated out during a contract for hardware, firmware, or software upgrades, billing must connect to the new asset. So in parallel with the contract lifecycle is a mass of asset activities that must be reported to the finance team.

This is typical: HaaS contracts are substantially more complex than either a SaaS contract (“use cloud software”) or a traditional hardware contract (“buy physical machine”). Every HaaS finance team needs to define billing triggers within contracts: which real-world activities are linked to invoicing events?

As the leader in hardware financial operations, Hardfin has seen thousands of HaaS contracts and advised hundreds of finance executives on determining their billing and revenue triggers. So Hardfin customers don’t have to rely on manual processes—whether internal or external. And finance teams can easily manage the complexity of hybrid billing for hardware and software.

“HaaS is a budding industry” says Jody Kelly, a fractional CFO who supports Fox Robotics. “Most accountants are accustomed to SaaS models or traditional hardware models. Hardfin makes it possible for an accountant to run their HaaS model easily. Hardfin’s customer team worked closely with us to set up product configuration, billing triggers, revenue triggers, and so on—then came back to guide the Fox team through managing ongoing invoicing.”

Digitizing fixed asset tracking

Hardfin tracks Fox’s asset lifecycle to automate data for contracts

Because a HaaS contract is defined by asset events, contract execution is dependent on the activity of every asset in the real world. In order to manage contracts, HaaS finance teams need to have visibility into where their assets are, know which company owns them, understand which assets are associated with each subscription, and track asset movements—shipment, delivery, deployment, maintenance, and exchange.

This also means coordinating the relationship between asset activity and the amounts due on each asset. Maintaining that data manually on spreadsheets—which is how many hardware companies try to track assets—is a cumbersome and exhausting full-time job, as it requires routinely reaching out to multiple departments to verify locations and context.

With Hardfin’s linked tracking capabilities, the Fox team simply inputs base contract information. When their ERP denotes a forklift in inventory, Hardfin picks up the asset serial and generates related invoicing automatically when forklifts are shipped, delivered, or deployed. No one has to create invoices manually. And with asset tracking, Hardfin recognizes when forklifts have been exchanged and can automatically associate software revenue to the new serial number. This gives Fox integrated management of their hardware financial operations.

“Hardfin recognizes every time a robot is exchanged,” says Kevin Reich, Director of Finance. “When our assets were tracked on spreadsheets, there was often miscommunication about forklift movement. There might even be no communication! The accounting cleanup was painful, and would have been impossible down the road. So we’re not only talking about existing automation with Hardfin; we’re talking about future preventive measures.”

Capturing cash faster

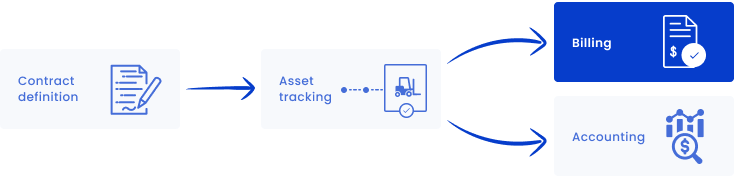

Hardfin automates Fox billing from linked contract and asset events

Standardizing contract and asset data is valuable, but the magic is how Hardfin connects them. For HaaS finance teams, contract rules plus asset actions equal faster cash. A down payment at contract signing might go along with prepaid training fees; a freight fee when hardware ships; and then the provider starts billing for software when assets deploy. Contract definition is built on asset tracking to invoice automatically and capture cash as fast as possible.

When a forklift is deployed, Fox may invoice each deliverable together or separately—it is important for subscription management to have flexibility to do both. Depending on the contract, some fees might be billed on forklift delivery, another on customer training, and other amounts when the forklift is operational. Customers’ deposits need to be applied across multiple hardware and software line items. That’s where Hardfin’s billing management came in. Before Hardfin, “that was an accounting nightmare,” shared Kevin.

“One of the challenges companies face is that there are multiple ways for contracts to outline invoice and payment triggers. Those triggers may include deposits on contract execution, 100% at shipping, or be based on milestones. Milestones are particularly difficult as they do not always match physical movement of assets. This can be further complicated when customer purchase orders do not match the billing cadence. When this happens, payment will be delayed,” explains Jody. “I’ve seen customers reject an invoice that does not clearly match the purchase order. With Hardfin, invoicing is generated directly from line items on the contract, and invoices are triggered by forklift activity—so everything always matches.”

This also means that time to cash decreases significantly. In HaaS operations, the time to send an invoice can sometimes be longer than payment terms, because processes are cumbersome for passing asset information between teams. Fox can now invoice for asset events the same day that the operations team records activity in the Hardfin platform. This saves weeks compared to tracking assets through spreadsheets and email.

Automating complex accounting

Hardfin solves revenue and depreciation schedules for Fox accounting

A HaaS finance team needs to combine contract rules and actual asset activity to generate revenue schedules. HaaS companies often get paid upfront and recognize revenue over time. Deferred revenue schedules can be remarkably complex for hardware subscriptions. Not only does the contract require assessment for the embedded lease rules under ASC 842, but HaaS contracts tend to have sophisticated multi-part performance obligations that require careful assessment to allocate the transaction price under ASC 606.

Fox packages some forklifts with multiple deliverables (e.g., battery, charger, warranty, software). But while the model is all-inclusive for Fox’s customers, the finance team has to break it down. “Now the process is streamlined. As contracts are executed, they are simultaneously created in Hardfin,” says Jody. “And the trigger is: When should each deliverable be recognized as revenue? How long is the contract? Is there a warranty included? Hardfin takes the information that’s recorded when a contract is executed and automatically calculates the right percentages for deferred revenue and revenue recognition.”

HaaS accounting teams not only have to manage revenue; they also have to wrestle with the costs of each asset and depreciation under ASC 360. Many HaaS companies struggle with spreadsheets to handle this—a highly manual and painstaking approach that is subject to human error. With Hardfin, asset activity can be dynamically linked to asset accounting. Hardfin allows Fox to transition leased forklifts from finished goods inventory to fixed assets at the right time, and export a fixed asset schedule alongside known asset activity. Paired with COGS tracking, which can be imported directly from the ERP, asset reporting and depreciation calculations are automatic.

“What’s happening on any HaaS company’s P&L is that a bit of revenue is recognized each month, and a bit of depreciation is recognized each month,” explains Kevin. “Maybe for the next 8 years, I have to do math every month on an asset that’s worth $3 in revenue, $2 in cost, and $1 in profit. Multiply that by the number of assets we have in the field, and I have an enormous headache! With Hardfin, all of that work is automated.”

Value creation opportunity

The value Hardfin has already created for Fox

For finance and accounting teams, the value of a software solution is partly in the hours of work saved—whether chasing down data or doing manual computations. That work happens to be larger at HaaS companies. The Fox finance team was spending hours each month identifying where their forklifts had moved. With Hardfin, that time is now being spent more effectively.

Hardfin creates a unified reporting layer so finance teams can take charge of their hardware financial operations. A business of Fox’s size and scale can expect to drive over $500,000 in value in the first year—between productivity from time saved, acceleration of cash from automated collections, and cost of capital opportunity from working capital optimization.

“Our monthly subscription with Hardfin costs less than taking care of one journal entry manually,” says Kevin. “So already, that’s saving dozens of hours and thousands of dollars per month. Then there’s bookkeeping savings thanks to Hardfin’s auto-generated invoices, which saves more time and more money. And that's just the immediate savings.”

Turn your hardware into revenue

Hardware-as-a-service (HaaS) is complicated. We understand the journey. Discover how Hardfin solves the dynamic challenges of modern hardware.